Some Financial Advice

I’m sporadically asked for financial advice related to personal finances, self-employment, and small business, so I wrote them down. I hope you find some of it useful. I would be surprised if you disagree with none of it. I’m based in Scotland, so these assume the UK financial/tax/employment system. Each list is in order of descending importance.

Personal

- Spend less than you earn, and spend significantly less if you earn a lot.

- Build an “emergency fund” that covers several months of unexpected unemployment while paying all your bills and living costs.

- Avoid debt (even interest-free) for anything except appreciating assets (e.g. mortgage). If you can’t buy it outright: you can’t afford it (yet).

- Have all your personal accounts in a single app on your phone, and check them regularly to avoid overdrafts.

- Build up a credit rating by having a credit card where you pay off the total balance with a direct debit every month. If you miss a single payment: you negatively affect your credit rating.

- Prefer fixed costs over variable costs, e.g. buy your phone or car outright instead of on contract. This allows you to stop paying for things immediately and usually saves money long-term.

- Charitable giving can be claimed back on your tax return or by contacting HMRC directly. The more you earn and give: the more you’ll get back.

- Buy cheap first, and only expensive when the cheap version breaks and you use it often.

- No matter how much money you have: weigh up the price difference vs the practical difference. A Land Rover is much more expensive than my Mitsubishi Outlander. Is it much more effective at the job? No.

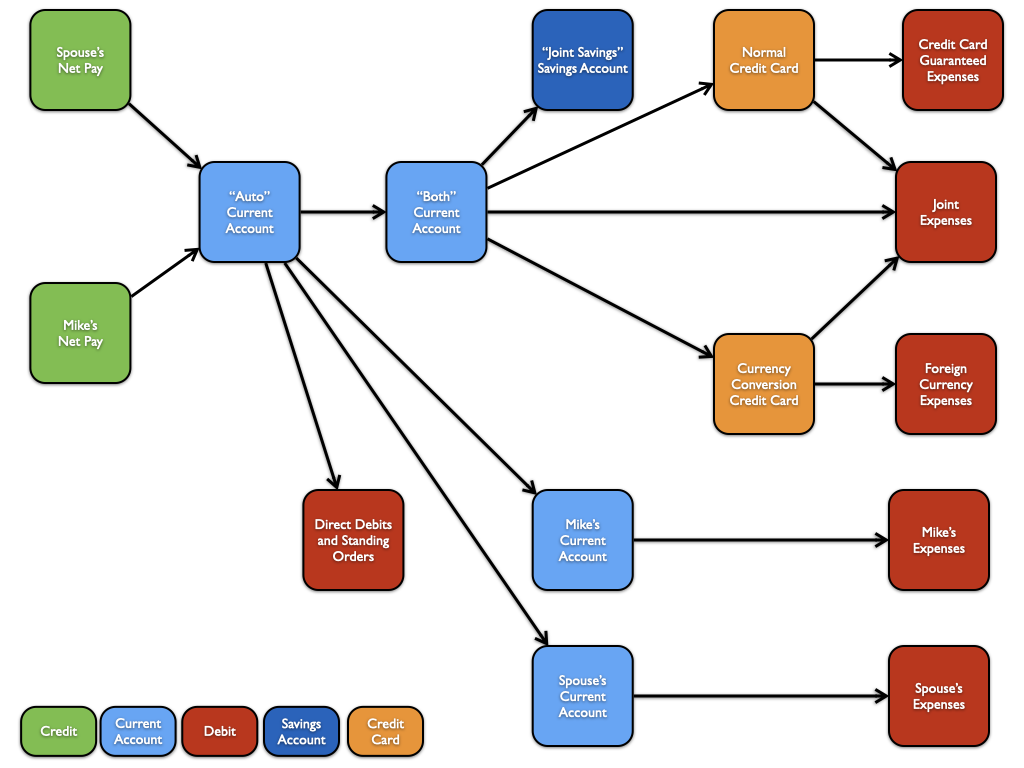

- If you’re married, both work and have kids: pool your finances. Put all your income into one account and distribute some “luxury money” to personal accounts to spend how you choose. You will be happier this way.

- Use multiple bank accounts for better organisation of your money and to help manage different financial goals. I don’t carry a card for my “Auto” account; it’s only for subscriptions, direct debits and standing orders. My “Both” account is most of my daily spending and doesn’t have subscriptions, direct debits and standing orders.

Self-employment

- Separate all your personal and business finances with different bank accounts.

- If you’re transferring money from the business to personal (or vice versa), do so with a bank transfer. Don’t just use the business card for personal purchases (or vice versa).

- Calculate your rough tax rate for this year (overestimate rather than underestimate) and automatically transfer this money into a business savings account for tax payments. Anything left over after paying your tax bill: you can pay yourself as a “bonus”.

- Use business accounting software (I loved Freeagent) to track all incoming/outgoing payments from all your business bank accounts, all your income and all your expenses. Do this work consistently, and doing your tax return at the end of the tax year will be very easy (FreeAgent makes it almost a single click).

- Do your own accounting and tax return. It’s not hard; ultimately, it’s on you to do most of the hard work anyway. A tool like FreeAgent will make this much more straightforward.

- The more you earn/tax you pay, the more money you “save” by putting (legitimate) expenses through your business.

Small business

- Prefer recurring monthly payments from customers over one-off payments. This should be set up with standing orders, direct debits or automated credit card billing.

- Inversely, choose one-off business expenses rather than recurring ones. Your cash flow can be badly harmed by too many recurring expenses.

- Raise your prices a small amount every year. People respond better to frequent, small price increases than large ones. If you don’t raise prices: inflation means you charge less yearly.

- You must charge more if you have more demand/customers than supply/time.

- All big business has different pricing for different customers getting the same service. It’s okay for you to do it too.

- Generic “business coaching” is often a scam. Getting your finances sorted is much more impactful than changing how you target customers (if you already have plenty).

General

- All financial advice, including the above, is situational, based on personal experience and may be entirely wrong for you. Use your best judgement.